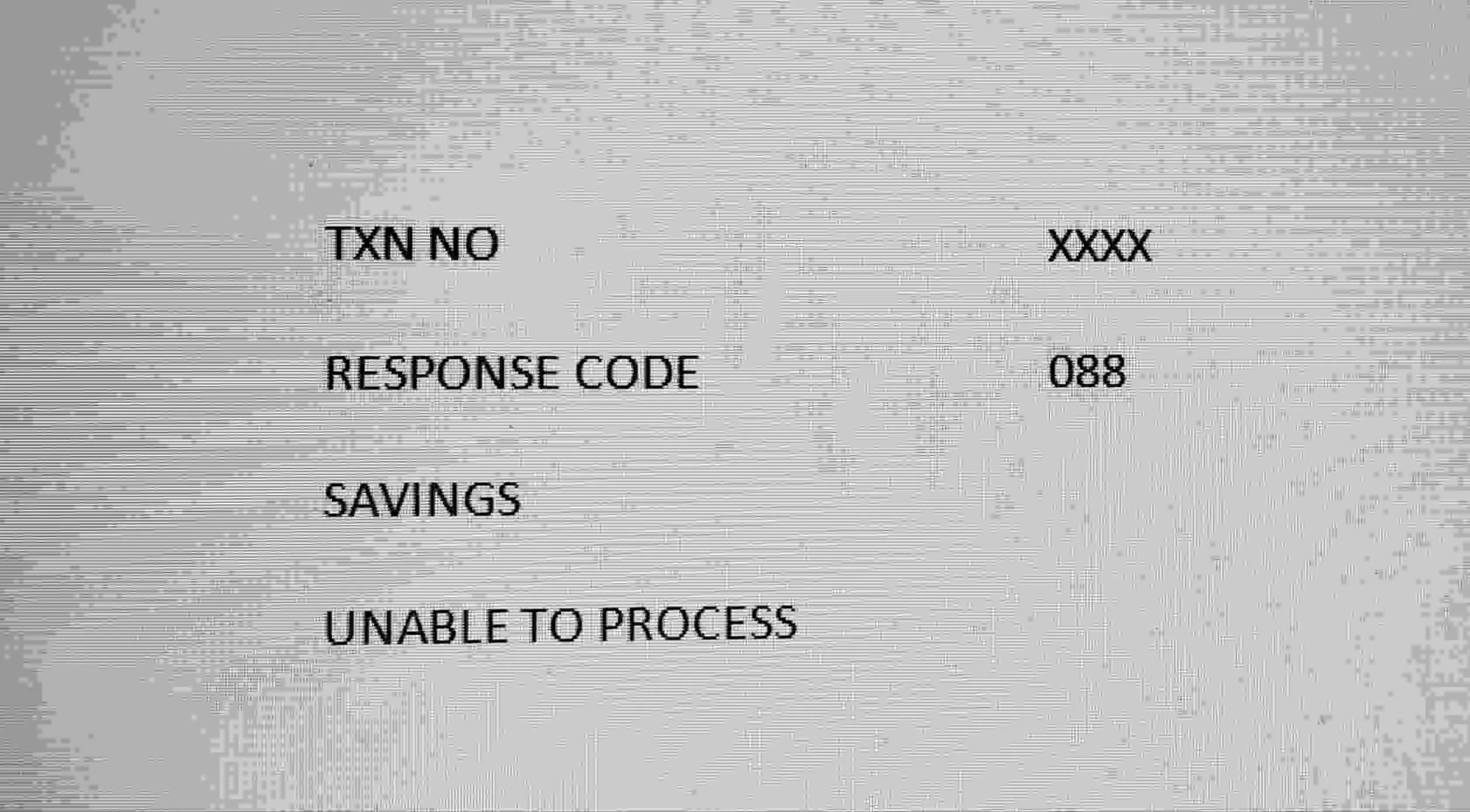

SBI ATM card transaction error code 088

Can we really fix the issue? If so, how? It’s seen that many card users had the issue, and it’s quite frustrating to be unable to transact through an ATM card.

Besides, it seems there is no solution available on the bank’s official website. Unless you visit the bank, this problem might not go away.

Reasons behind error code 088

When you go to an ATM booth to cash out money and you face the error code 088 issue, then there may be either one of two reasons.

Let’s see what could be the reason for your ATM card.

Reason 1:

The ATM is unable to read your card properly. In this case, either your ATM is damaged due to wear and tear from long use or the ATM card reader of that specific bank is not functional.

Your account details are stored on the ATM memory chip. If you casually keep it in your wallet, then there is a good chance that your card’s memory chip is damaged.

Here, the solution would be to get a fresh ATM card right away.

Reason 2:

If you are using an old ATM card, see if it’s a magnetic strip card. Banks have long discontinued issuing magnetic strip ATM cards due to their low security features.

since banks are issuing only EMV chip ATM cards. By the way, EMV stands for Europay, MasterCard, and Visa. It refers to a card with a memory chip.

Back to the topic, if your ATM card is a magnetic strip card, it is apparent that it would not work at all, and the card reader will fail to do its task with the error code 088- unable to process.

How do we fix the error code 088- Unable to Process?

Yes, definitely; that’s the issue. How do we fix it? In case you are out of town and badly in need of quick cash, what do we have to do?

Any alternative might as well work. Let’s see some viable options.

- If your ATM is an EMV chip card, then trying different ways would not lose anything. You may clean the card with a clean cloth; a handkerchief will do. Clean it nicely and try it once again. It might surprise you.

- An alternative is that if you are using SBI YONO, you might be able to encash up to ₹20000 without an ATM card. This one is really nice. Try it out, and you may like this cardless ATM transaction.

- If you can use the SBI Bhim QR code for payment, that would also serve the purpose. To activate it, you may have to login to SBI Internet Banking, and you can perform payment transactions just by scanning the QR code of the beneficiary through your phone.

Conclusion

In case you are facing the issue of an SBI ATM card transaction with the error code 088- Unable to process, you definitely need to apply for the fresh one.

Even if your existing card is working, receiving this error code is an indication that it will stop working sooner or later.

It’s certain that there is something wrong with the card, and you don’t want to have any complications when in urgent need.

Considering that you are not conversant with technology, having SBI YONO or its internet banking is out of the question. To avoid ending up purchasing goods on credit, apply for a fresh ATM card as soon as possible if you face the issue of error code 088.

Shashi Kant

Thanks for the explanation it sure is helpful

Way cool! Some extremely valid points! I appreciate you penning this post and the rest of the website is also very good.

There is certainly a great deal to learn about this topic. I like all of the points you’ve made.

Very good article. I’m experiencing many of these issues as well..

Excellent advice. The customer care asked me block the card and apply again for new one. As given in ur article, I cleaned the surface softly with a fresh lintfree cloth and the card WORKED. As good as new. Thanks. I always keep it in a zip lock cover…

I delight in, lead to I discovered exactly what I was having a look for. You have ended my four day lengthy hunt! God Bless you man. Have a nice day. Bye

Its like you read my thoughts! You appear to grasp so much approximately this, such as you wrote the book in it or something. I think that you could do with some p.c. to pressure the message house a bit, but other than that, this is wonderful blog. A fantastic read. I’ll certainly be back.

It’s amazing for me to have a web site, which is valuable in support of my know-how.

thanks admin

Also visit my web blog :: buy likes and followers instagram app

I just could not go away your site before suggesting that I extremely

enjoyed the standard info a person provide on your guests?

Is gonna be back steadily in order to check out new posts

Check out my blog; best time to post on instagram for likes thursday

Greetings from Ohio! I’m bored to tears at work so I decided to browse your website on my iphone during lunch break. I love the information you present here and can’t wait to take a look when I get home. I’m amazed at how quick your blog loaded on my cell phone .. I’m not even using WIFI, just 3G .. Anyways, great site!

It’s perfect time to make some plans for the future and it

is time to be happy. I’ve read this post and if I could I desire to suggest you some

interesting things or suggestions. Perhaps you can write next articles referring to this article.

I want to read more things about it!

Here is my web site; twicsy review

What i don’t understood is actually how you are not actually much more well-liked than you might be now. You’re so intelligent. You realize thus significantly relating to this subject, made me personally consider it from numerous varied angles. Its like men and women aren’t fascinated unless it?s one thing to accomplish with Lady gaga! Your own stuffs nice. Always maintain it up!

Wow that was odd. I just wrote an really long comment but after I clicked submit my comment didn’t appear. Grrrr… well I’m not writing all that over again. Regardless, just wanted to say excellent blog!

Valuable info. Lucky me I found your website by accident, and I’m shocked why this accident didn’t happened earlier! I bookmarked it.

Thank you, I’ve recently been looking for facts about this topic for ages and yours is the best I have discovered so far.

Hi, everything is going fine here and ofcourse every one is sharing data, that’s in fact good, keep up writing.

Also visit my site apps to buy followers on tiktok

Hi there, I found your blog by means of Google whilst looking for a similar topic, your website came up, it seems to be good. I’ve bookmarked it in my google bookmarks.

Wow! This blog looks just like my old one! It’s on a entirely different topic but it has pretty much the same page layout and design. Excellent choice of colors!

Do you mind if I quote a couple of your posts as long as I provide credit and sources back to your website? My blog is in the exact same niche as yours and my users would really benefit from some of the information you provide here. Please let me know if this alright with you. Cheers!

Sure

I’m extremely inspired together with your writing abilities and also with the layout in your weblog. Is that this a paid topic or did you modify it yourself? Anyway stay up the nice quality writing, it?s rare to see a great weblog like this one today..

I haven?t checked in here for a while since I thought it was getting boring, but the last several posts are great quality so I guess I will add you back to my everyday bloglist. You deserve it my friend 🙂

One thing I’d like to say is the fact car insurance canceling is a dreadful experience so if you’re doing the right things as a driver you may not get one. Some individuals do receive the notice that they’ve been officially dropped by their particular insurance company and many have to struggle to get additional insurance following a cancellation. Low cost auto insurance rates are frequently hard to get from a cancellation. Having the main reasons concerning the auto insurance cancellation can help motorists prevent getting rid of in one of the most vital privileges offered. Thanks for the ideas shared by your blog.

Have you ever thought about adding a little bit more than just your articles? I mean, what you say is fundamental and everything. Nevertheless imagine if you added some great graphics or videos to give your posts more, “pop”! Your content is excellent but with pics and clips, this blog could certainly be one of the most beneficial in its field. Terrific blog!

Someone essentially help to make seriously articles I would state. This is the first time I frequented your web page and thus far? I surprised with the research you made to make this particular publish incredible. Excellent job!

Thanks on your marvelous posting! I seriously enjoyed reading it, you

can be a great author.I will be sure to bookmark your

blog and will eventually come back from now on. I want to encourage you to ultimately

continue your great posts, have a nice morning!

my page Check Out Your URL (ameblo.jp)

Thank you for every other excellent article. The place else may anyone get

that type of info in such an ideal way of writing? I have a presentation subsequent week, and I am at the search for such info.

Feel free to visit my homepage – my site (wiki.kalkku.fi)